How to Pay for Assisted Living: A Comprehensive Guide

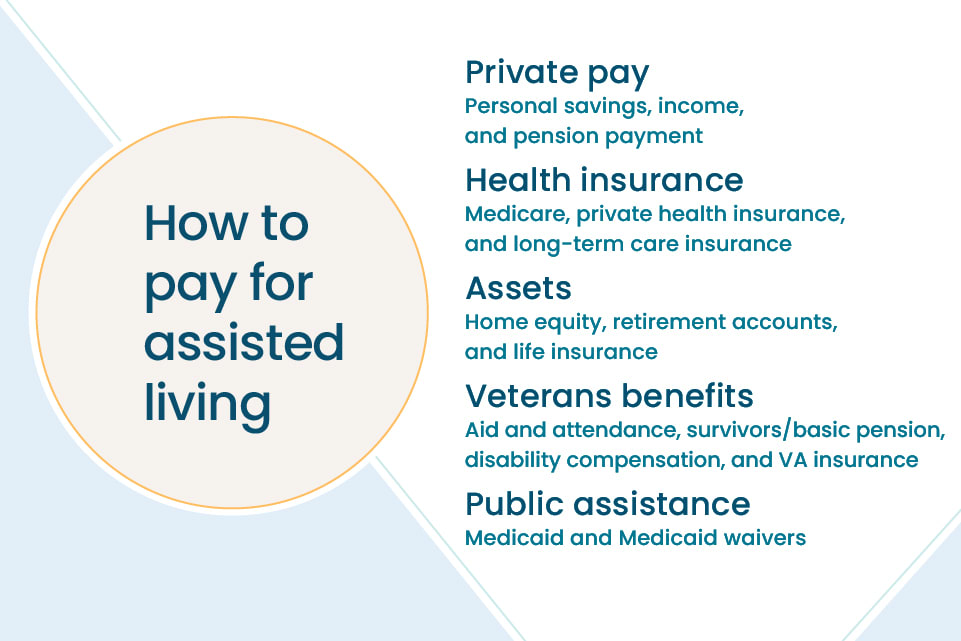

People pay for assisted living using a variety of sources such as savings, retirement funds, life insurance policies, and other assets. Seniors with long-term care insurance or who qualify for Medicaid or VA benefits may receive more assistance. Many families are disappointed to learn that assisted living isn’t covered by Medicare or other health insurance, since it’s a form of long-term care. This is why it’s important to have a plan that covers long-term senior care needs. Luckily, it’s common to negotiate with assisted living communities and look for other ways to save.

Can you afford assisted living?

Let our free assessment guide you to the best senior living options, tailored to your budget.

Key Takeaways

- Many people rely on private funds for assisted living. Examples include using personal savings, pension payments, or retirement accounts.

- Some people find other ways to use existing assets. A reverse mortgage or selling a life insurance policy are both options.

- Get creative to save on costs. You can ask communities about price flexibility or take advantage of tax credits.

- Find assisted living that fits your budget. Narrow your search based on price range and other important community features.

Who pays for assisted living?

Most families use private funds to pay for assisted living, like personal savings, pension payments, retirement accounts, or a combination of any of these. Some public health insurance policies, like Medicaid, can also help offset assisted living costs for low-income families.

Once you have a rough idea of your budget, consider which features your parent prefers and how much care they’ll need. Below are common payment options.

Private pay

This includes personal savings, income, and pension payments.

Private health insurance

Private health insurance policies can be used to cover long-term care.

Assets

Home equity, retirement accounts, and life insurance policies can all be used to pay for care.

Veterans benefits

Each benefit has different requirements and may require a separate application. Aid and Attendance, VA Survivors Pension or basic pension, disability compensation, and VA health insurance can all be used for assisted living care.

Public assistance

Medicaid offers home and community based services waivers that let seniors get care in an assisted living community instead of a nursing home. Other programs can also provide assistance and vary by state.

Private pay financing options for assisted living

Many families use private pay as their first option to pay for assisted living. Private pay includes things like private insurance policies, home equity, pensions, and other sources of income or assets.

1. Private insurance

Older adults often rely on health insurance to cover medical procedures, hospital stays, and other medical care services. Depending on your insurance policy, you may be able to claim some medical services that take place in some assisted living facilities.

| Payment option | How it works | Advantages | Drawbacks |

|---|---|---|---|

| Medicare | It can pay for short-term medical-care services offered in an assisted living community, like physical therapy. | You can claim things like medication management and insulin injections, which may be helpful for seniors with medical conditions that can be covered by Medicare’s chronic care management services.[01] | You can’t claim assistance with personal care tasks such as bathing and dressing. Be sure to ask the community if they accept Medicare for medical care services. You’ll likely need an itemized monthly bill to submit claims. |

| Private health insurance | You may be able to submit claims to cover some skilled nursing health care costs. | As with Medicare, you can claim medically necessary care received at the community. | Contact the insurance company to determine what types of care they cover. Most providers don’t cover the cost of personal care assistance. You’ll also need to ask the community whether they accept private insurance. |

| Long-term care insurance | Most policies go into effect once the policy holder can no longer perform two activities of daily living. Your loved one can then be reimbursed for personal care assistance offered by their community. | This type of insurance covers assistance for bathing, dressing, and other personal care tasks offered in assisted living. | These insurance policies need to be bought before the policy holder needs help with personal care. This often means buying a policy before turning 60. The policy should be in good standing, and you’ll need to confirm that it covers care in assisted living. |

Can you afford assisted living?

Let our free assessment guide you to the best senior living options, tailored to your budget.

2. Life insurance policies

Many people don’t know that you can use life insurance to pay for assisted living. Selling a policy to a third party for market value frees up funds to buy a long-term care benefit plan. You can usually keep some death benefits.

Or, you can “surrender” a life insurance policy to the company for cash value. In this case, you give up ownership and won’t get any benefits upon death.[02]

3. Home equity

Tapping into home equity can be another way to help pay for assisted living. If your loved one owns a home or other property, consult with a financial advisor before moving ahead with a loan, mortgage, or home sale.

| Financing option | How it works | Advantages | Drawbacks |

|---|---|---|---|

| Bridge loan | This short-term loan is good for urgent situations since it can help homeowners gain cash flow quickly. | This loan can be used to pay for assisted living while freeing up assets or waiting for the home to sell. | Someone will need to make payments on the loan until the house is sold. |

| Reverse mortgage | This option lets the borrower tap into home equity and get money as a lump sum or as needed. | Sometimes, a senior’s spouse or adult children may be able to continue living in the home. It depends on the lender and who is on the deed of the house. | Many scams target seniors interested in reverse mortgages. It’s very important to work with a trusted bank. |

| Selling or renting the home | Depending on how much money you need, selling or renting can increase your cash flow to pay for assisted living. | Although selling offers more cash up front, renting the home can also be a good option. It gives your family time to make sure they want to sell. | Other family members may live in the house, or want to keep it in the family. Make sure to give everyone involved plenty of time for this change. |

4. Social Security

Social Security can help pay for assisted living. While this money isn’t enough to pay the entire bill, it can make assisted living more affordable. Other Social Security programs can also help, such as Supplemental Security Income and optional state supplements.

Using other benefits to fund assisted living

In some cases, your loved one may be eligible for benefits or a stipend to cover some assisted living costs. This could apply if your loved one:

- Served in the military

- Worked for the government

- Worked for a railroad

Wartime veterans and spouses may qualify for a pension program through the Department of Veterans Affairs (VA) to offset care costs. Our Guide to VA Benefits and Long-Term Care includes detailed information about how to apply, what’s included, and eligibility.

Federal and postal employees, as well as qualified relatives, can apply for Federal Long Term Care Insurance (FLTCI) before retirement. This insurance can help pay for assisted living expenses. However, some medical conditions may prevent approval.[03]

Expert advice for affordable assisted living

Tell us your care needs to receive options tailored to your budget.

Public pay: Using Medicaid to pay for assisted living

Medicaid can help cover medical assisted living costs for qualifying low-income seniors. Medicaid is a state-regulated resource, so applying and qualifying — along with what’s covered — will vary from state to state.

Not every assisted living community accepts Medicaid, though. If you can’t find a Medicaid-approved community, you may be able to apply for a waiver. Paying for assisted living with Medicaid can be a good option for seniors who qualify.

6 tips to stretch your assisted living budget

Even with the above benefits, senior care can be expensive. Taking the time to understand all the ways to pay for assisted living can help you save. Discover how to pay less for assisted living with these six tips.

1. Ask about price flexibility and specials

Depending on the location and time of year, assisted living communities may be willing to offer a discount to fill vacant rooms. Many facilities offer deals at the end of the month or during seasons with lower move-in rates.

Ask these questions during your tour:

- Are there any move-in incentives?

- Do you have any specials available?

- Is the community willing to negotiate its monthly price?

- Can the entrance fee be waived?

- Can you offer a month free if we sign up for an extended lease?

- Are there any discounts available with lump-sum payments?

2. Compare a la carte costs with inclusive pricing

When you’re making your assisted living budget, it’s important to understand the price structure your community uses. Some assisted living communities let families choose between an all-inclusive rent fee and paying for services individually based on need. Figuring out the best option for your needs will help you plan and budget more efficiently.

| Payment option | How it works | Advantages | Drawbacks |

|---|---|---|---|

| A la carte | This lets you pay for services or items separately based on need. Services include personal care tasks, laundry, housekeeping, meal delivery, and more. | If your parent has family nearby who can help with some tasks, this option can save money in the long run. | If something unexpected happens and your loved one’s care needs increase, so will your payments. |

| All-inclusive | In this model, a monthly fee covers a range of services so there are no surprise costs. | If you’re expecting your loved one’s care needs to increase over time, all-inclusive payments are often a better value. | Even communities with an all-inclusive model may have some services, such as meal delivery to your relative’s room, that aren’t included. Be sure to get a list of the included services. |

3. Consider a roommate

In many senior living communities, a shared space is cheaper than a single room or apartment. Besides saving money, sharing a room can be safer and prevent loneliness, a common problem among seniors. Be sure to consider your loved one’s personality, as many residents do look forward to their own private space.

4. Enroll in discount programs for essentials for low-income seniors

Your loved one may qualify for senior benefit programs that help them save money. These funds can then go toward assisted living.

The National Council on Aging (NCOA) lists several benefits programs for vulnerable adults or low-income seniors to save on:

- Drug prescriptions

- Food

- Hearing care

- Dental care

- Vision coverage

5. Save on moving expenses

Hiring a senior move manager can be a smart choice. These professionals can help cover downsizing and transition costs, which may come out of your assisted living budget. Move managers may be able to help you determine the least expensive time to move. They can also guide you on how to sell possessions to help cover assisted living costs.

Most senior move managers partner with estate agents to help organize sales of personal collections, antiques, cars, and other belongings. Many assisted living communities offer referral discounts for senior-specific relocation services.

6. Explore tax credits and deductions

One surprising way to recoup assisted living costs is through senior and caregiver tax credits. If your parent meets the IRS’s definition of “chronically ill” or needs help with two or more ADLs, they may qualify for medical tax deductions.[04] Relatives who pay for at least 50% of a loved one’s care may also be eligible for caregiver tax credits.

Assisted living payment tips and resources

As you review communities, these tips and resources can help with every stage from budgeting to moving.

1. Create an assisted living budget

It can be hard to compare the cost of assisted living to your loved one’s current expenses. Assisted living combines many services that you pay for individually when living at home. For an accurate idea of how your loved one’s current expenses compare to assisted living, try using our senior living cost calculator. It’s a great tool to help families as they start making their budget.

Once you review your assets and expenses, you’ll have a good idea of your assisted living budget. Collect information for each account and gather it in one document so you can clearly see all your payment sources. It might help to choose one account to draw from first while working on freeing up cash from other sources, such as selling a home.

When you’re creating your budget, keep in mind how long your loved one might be in their chosen community. Many factors determine how long a senior lives in a senior living community, but you can expect an average of two to three years of care.[05]

2. Compare communities easily with a touring checklist

As you tour communities, keep track of what you like about each of them with our Assisted Living Touring Checklist. You can use it to keep track of a community’s staff, living units, amenities, and activities. This makes it easier to find communities based on what’s most important for your loved one while staying on budget.

3. Plan for moving day

Moving day involves so much more than packing. A Place for Mom’s Moving Checklist helps you keep track of everything to make moving day as easy as possible. Check off everything from disconnecting old utilities to choosing furniture and clothes.

4. Seek expert advice and caregiver support

A Place for Mom’s Senior Living Advisors have experience helping families find affordable senior living. They can offer you community suggestions to fit your budget while providing your loved one with an enriching community to live in — all at no cost to your family.

You can also visit AgingCare’s Caregiver Forum to find out how other caregivers have handled care for their loved one. Sometimes, your best support can come from a group of others who are making the same decisions you are.

Centers for Medicare and Medicaid Services. Chronic care management services. Medicare.gov.

Administration for Community Living. (2020, February 18). Using life insurance to pay for long-term care.

U.S. Office of Personnel Management. Federal long term care insurance program (FLTCIP).

IRS. (2022, January 13). Publication 502 (2021), Medical and Dental Expenses.

Administration for Community Living. (2020, February 18). How much care will you need?

Assisted living in all states

The information contained on this page is for informational purposes only and is not intended to constitute medical, legal or financial advice or create a professional relationship between A Place for Mom and the reader. Always seek the advice of your health care provider, attorney or financial advisor with respect to any particular matter, and do not act or refrain from acting on the basis of anything you have read on this site. Links to third-party websites are only for the convenience of the reader; A Place for Mom does not endorse the contents of the third-party sites.

Find assisted living that fits your needs and budget

Find assisted living that fits your needs and budget