Does Medicaid Pay for Assisted Living?

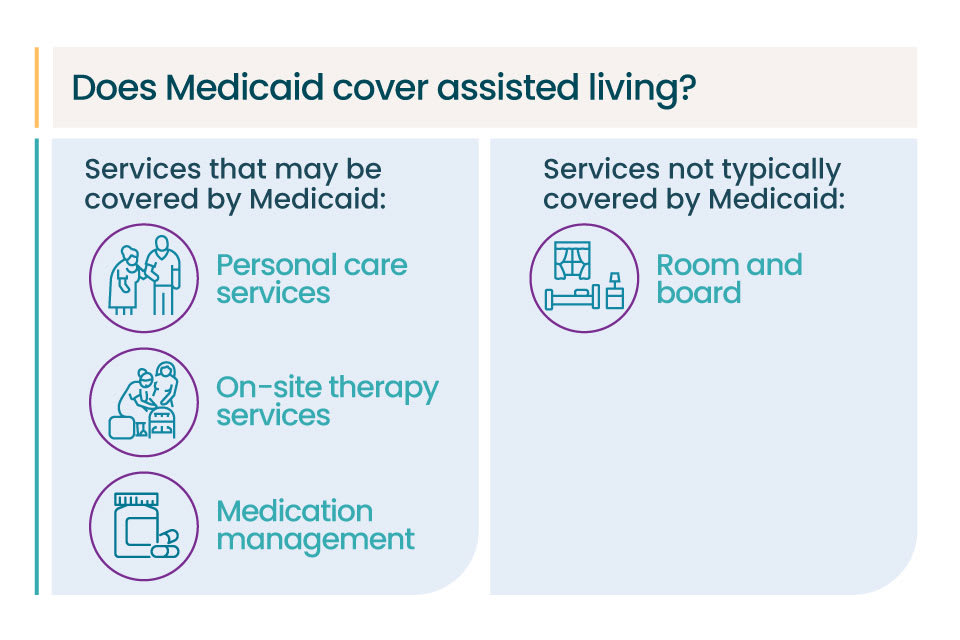

Medicaid doesn’t pay for the cost of room and board in assisted living. However, Medicaid can help with other assisted living costs. Seniors who already receive Medicaid can apply for home and community based services (HCBS) waivers to help cover their costs of assisted living. The HCBS waivers available will vary by state and may have different requirements. These waivers are designed to help seniors receive care in their home or assisted living community instead of in a nursing home. Since Medicaid doesn’t cover the total cost, many families use other payment methods to supplement.

Can you afford assisted living?

Let our free assessment guide you to the best senior living options, tailored to your budget.

Key Takeaways

- Medicaid doesn't pay for the room and board portion of assisted living. This is one of the largest assisted living expenses.

- Medicaid waiver programs can help cover the cost of care services. Waivers vary by state and sometimes have a waitlist.

- The amount that Medicaid will pay for assisted living will vary. Some states may have copayments, coinsurance, or deductibles.

- Medicaid may also cover some alternatives to assisted living. These include home care and adult day services.

The cost of assisted living

Given the high cost of senior care, paying for assisted living often requires planning ahead of time. The median cost for assisted living in 2023 was $4,995 per month, according to A Place for Mom’s 2024 report on the cost of long-term care and senior living.

Families may find it necessary to rely on long-term care insurance or personal sources such as retirement savings. Some insurance companies will allow customers to use a life insurance policy to pay for long-term care. However, these particular assets typically disqualify an individual from Medicaid coverage for assisted living care.

What assisted living costs does Medicaid cover?

The following care services and supports can often be covered by a Medicaid waiver:

- Long-term care provided by assisted living communities and residential care homes

- Inpatient and outpatient hospital services not covered by Medicare

- Home health services

- Prescription drugs

- Physical, occupational, or speech therapy

- Eyeglasses and hearing aids

- Personal care services

- Medication management

- Hospice care

- Copays for hospitalization and skilled nursing care not covered by Medicare

Coverage through Medicaid waivers

Medicaid is a federal health insurance program that’s jointly administered by the federal and state governments. This means that what Medicaid covers will be a little different in each state.

Most states offer home and community based services (HCBS) waivers that help cover some long-term care costs. The use of HCBS waivers gives individual states flexibility in their different programming, like programs to expand care for certain groups of people at reduced costs. Waiver availability and what each waiver program covers will vary.

HCBS waivers are an example of a program that provides specific options for Medicaid beneficiaries. Each state can create their own HCBS waivers to support the needs of specific groups. This allows qualified individuals to receive care services in their home or community as opposed to an institutional setting.[01]

For more information on Medicaid and the available waivers in your state, visit Medicaid’s state waivers list.

Can you afford assisted living?

Let our free assessment guide you to the best senior living options, tailored to your budget.

How to apply for Medicaid

To qualify for Medicaid, a person must meet several requirements:[02]

- Their income must fall below a state’s Medicaid income limit, or their medical-related care expenses must exceed their income.

- Their countable assets must fall within acceptable ranges.

- They must reside in the state where they wish to receive benefits.

- They must be a permanent resident of the United States or have U.S. citizenship.

- They must medically require care.

Each state has its own application guidelines, so it’s important to contact your state’s Medicaid assistance office for more details. You can also contact an elder law attorney who can walk you through the nuances of eligibility for Medicaid benefits and its application process. Be sure to request a list of all Medicaid programs in your state that your loved one may be eligible for.

Here are some other questions to keep in mind when speaking with an agent:

- What’s the process for applying for Medicaid?

- Are there social workers or case workers available to assist with the application process?

- Is there a waiting list? If so, how long is it? Are they currently adding individuals to the list?

- What are the income and asset qualifications for Medicaid waiver programs?

- Are there any programs that provide services in the home?

- Is there a state-funded assisted living program?

What assisted living facilities accept Medicaid?

It’s important to note that not all assisted living communities will accept payments through Medicaid or a Medicaid wavier. To find a community that does, contact your prospective community. You can also contact your local Medicaid office, Department of Aging, Department of Elder Affairs, or social service agency. They can help you understand your loved one’s care options.

Expert advice for affordable assisted living

Tell us your care needs to receive options tailored to your budget.

How much will Medicaid pay for assisted living?

The specific amount that Medicaid will pay for assisted living varies for each person. Certain states may impose copayments, coinsurance, deductibles, and other similar charges for nonemergency services based on an individual’s income.[03]

Other ways to pay for assisted living

When considering payment options, know that you’ll likely have to pay some assisted living costs out of pocket or through other means. Even with a waiver, Medicaid won’t cover the cost of assisted living in full.

It’s common for seniors and families to combine several payment options to cover the cost of assisted living. These include but aren’t limited to the following:

- Funds from the sale of a home

- Long-term care insurance policies

- Life insurance

- Veterans benefits

Does Medicare pay for assisted living?

Medicare doesn’t pay for most assisted living expenses. It only covers eligible medical expenses and short-term care. Unlike Medicaid, Medicare doesn’t offer waivers to help pay for long-term care services provided in an assisted living facility.

Read more:Medicare, Medicaid, and Long-Term Care

Alternatives to assisted living that may be covered by Medicaid

If you want to consider other care options, Medicaid waivers may cover some alternatives to assisted living, such as:

- Adult day services

- In-home nursing care and therapy services

- Care coordination and case management

- In-home care, which may include help with cooking, cleaning, or other daily activities

If you (or a loved one) are currently in a skilled nursing facility under Medicaid, one payment assistance option is the Medicaid program called Money Follows the Person.[04] It provides states with federal funding to help seniors move out of facilities like nursing homes and back into their own homes or community.

The Program of All-Inclusive Care for the Elderly (PACE) is another community-based Medicaid offering that provides both medical and social services to eligible seniors.[05] PACE is designed to deliver coordinated care through an interdisciplinary team of health professionals who are assigned to PACE participants. The program provides an alternative to nursing homes and allows many seniors to receive care in their own homes.

While the cost of assisted living continues to increase, there are a number of resources to help low-income seniors pay for care. If you have additional questions or need guidance searching for assisted living options, a Senior Living Advisor at A Place for Mom can help. They’ll provide information to help you find the communities that best fit your family’s financial and care needs. This service comes at no cost to you or your loved one.

Key Takeaways

Centers for Medicare and Medicaid Services. Home and community based services.

Centers for Medicaid and Medicare Services. Eligibility.

Centers for Medicare and Medicaid Services. Cost sharing out of pocket costs.

Centers for Medicare and Medicaid Services. Money follows the person.

Centers for Medicare and Medicaid Services. Program of all-inclusive care for the elderly.

Assisted living in all states

The information contained on this page is for informational purposes only and is not intended to constitute medical, legal or financial advice or create a professional relationship between A Place for Mom and the reader. Always seek the advice of your health care provider, attorney or financial advisor with respect to any particular matter, and do not act or refrain from acting on the basis of anything you have read on this site. Links to third-party websites are only for the convenience of the reader; A Place for Mom does not endorse the contents of the third-party sites.

Find assisted living that fits your needs and budget

Find assisted living that fits your needs and budget